Two minutes of your time to provide a meaningful fan voice.

Very quick one today. Our next article will draw on what has changed regarding the financial landscape of Scottish football since 2012 (which was covered in Stigma in Scottish Football- Intro and Part 1: Too Big To Fail).

It’ll address whether the finances of football clubs are now better run since that period that saw Rangers go into liquidation then Hearts and Dunfermline hit administration.

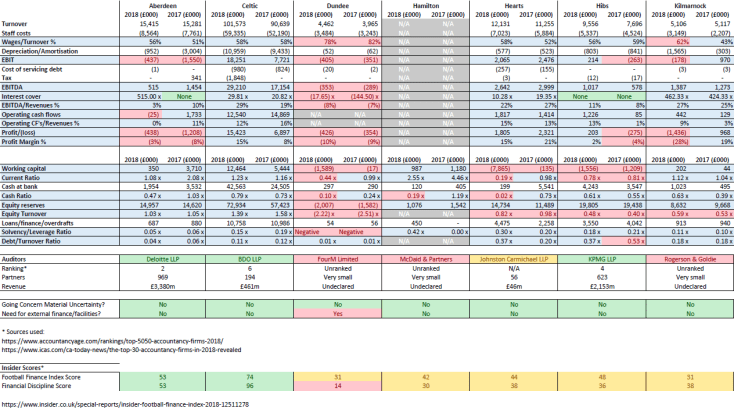

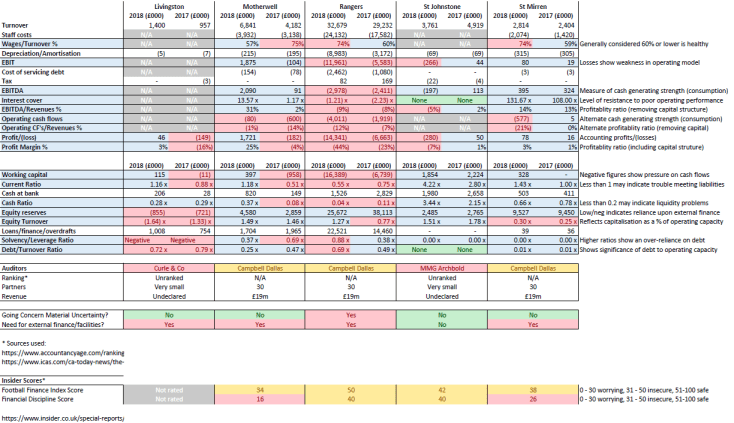

Your help to this will be invaluable. I recently leaked through twitter (follow us at @FansScarves) the financial analysis of the 2018 accounting periods for the top flight clubs, which I’ll reproduce below for your consideration. They show using metrics used in the Finance industry how healthy football and its clubs are right now. We spoke recently with representatives of the SPFL who felt clubs were now being run sustainably, as shown by a lack of insolvency events since 2014. Still rumours reach us through the financial grapevine of certain clubs facing financial failure.

If you can spare 2 minutes to fill out this survey on your feelings towards whether Financial Fair Play within Scottish domestic football would be beneficial and help prevent future financial failures, it would help us enormously both in gauging fan opinion on the subject and in any future such discussions with footballing authorities. Thank you in advance!

https://www.surveymonkey.com/r/HQWBZWG

The Financial Analysis

Could you give a commentary on what those numbers mean for Hamilton Academical (internally) and how they compare to the rest of the clubs. What do all the colours mean? Did I miss the index?

LikeLike

It’s quite hard to compare Hamilton as they didn’t release P&L figures. The balance sheet doesn’t look immediately alarming (red indicates things to be a bit concerned about) but you can see the equity reserve dropped by about £500k in the last year indicating large losses. 2 more years like that would see them reaching balance sheet insolvency (more liabilities than assets) but it really is limited data for them

LikeLike